It’s year-end which means you need to be preparing for printing and filing your ACA information. On November 29, 2018, the IRS extended the deadline to furnish the 1095-C forms to employees from January 31, 2019 to March 4, 2019. However, they did not adjust the filing deadline which is April 1, 2019. All the necessary updates to print and file your ACA information were included in the Vista US Year End release which was made available to customers on November 30, 2018. For Vista 4.1 customers that is ptf 120 and for Vista 7 customers that is Vista 7.0.4.

As you know, you should have been running the Issue Detective and reviewing your staging information throughout the year. Best practice is to run the Issue Detective at a minimum on a weekly basis and review your staging information monthly. When the Issue Detective runs, it sends an email alert showing the number of issues for each notification type and the location of each. This process assists with diagnosing specific problems that have been known to interrupt important processing jobs like ACA jobs to create 1095-C records, to create the 1094-C records, and others. The Issue Detective can be accessed on the processing screen from HR, Payroll or Benefits.

The Issue Detective has two parameters: Notification Category & Notification group

Notification Category: Select a specific category from the drop-down list box to receive notifications for just that category. Otherwise, the system includes all notification.

Notification Group: By default, notifications are divided into three groups—Event, Issue, and Other. To limit the Issue Detective to a single group, select it from the drop-down list box.

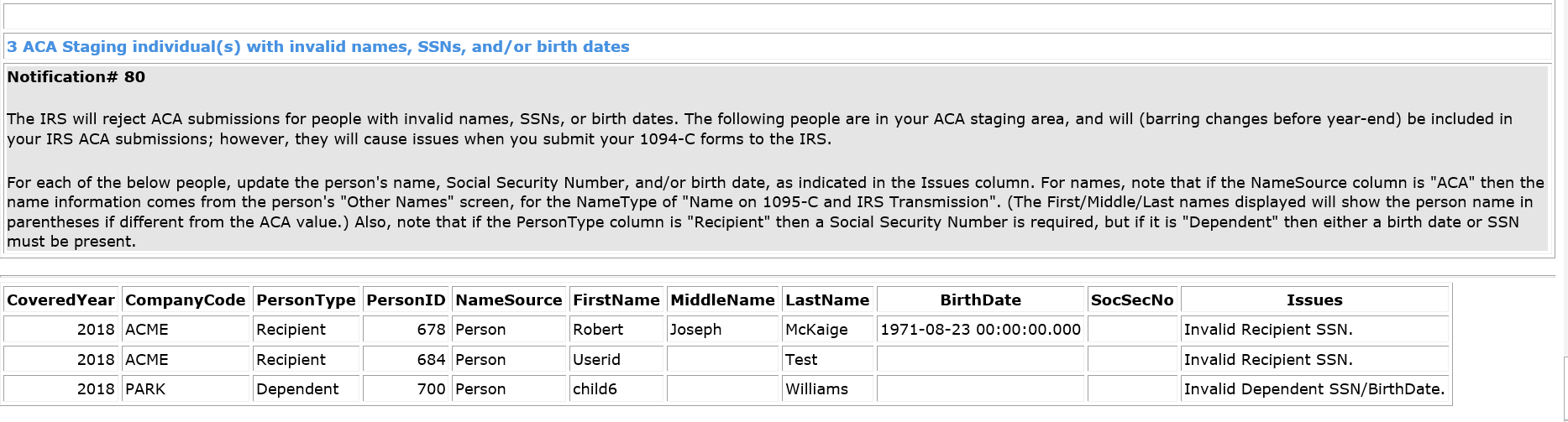

Here is an example of an ACA related issue:

This notification displays all the staging individual(s) with invalid names, SSNs, and/or birth dates. These issues need to be resolved or this could cause your files to be rejected when you submit your 1094-C transmission file to the IRS. Detailed information is provided for each instance, allowing you to locate the problematic data and correct it.

Once you correct any errors reported with the Issue Detective and have reviewed your staging data, you are ready to print your 1095-Cs for your employees.

After your 1095-C forms are printed, you are ready to create your XML transmission file for the IRS. Best practice is to wait a few weeks after distributing your 1095-C forms to give your employees time to review them and notify you of any changes. Yes, the IRS moved the deadline to distribute the 1095-Cs to your employees but why wait? You have everything you need to print your 1095-Cs in January.

For more detailed information on ACA from setup to processing, please reference the Benefits Manual–Chapter 5. There is also a VistaFlix ACA Refresher video on the Support site. Keep in mind that PDS offers printing and filing services. You can find all the details on the Support site under the Affordable Care Act link.

Yvette Strosser

Customer Support Manager

ystrosser@pdssoftware.com