Affordable Care Act reporting is a year-end thing, right? Wrong; in fact, it’s something you should be keeping tabs on all year. Ideally, you’d review your ACA data monthly, as the data on Forms 1094-C and 1095-C is monthly. Here are the top reasons you should make ACA reporting part of your routine.

It’s a Time-Saver

Regular auditing of your ACA data can save you loads of time at year-end for one simple reason: what happened in the past month is a lot easier to remember than what happened many months ago. Consider this hypothetical scenario: a data entry error on an employee’s record causes their HR status date to be incorrect. You might not notice this for internal reporting, but ACA relies on it to determine employment information.

If the error occurred in January, and you don’t review your data until year-end, that employee’s ACA record may require corrections for every month of the year, but that’s not the hard part: you must first identify it as a problem, and then figure out how it happened before you can do any correction. Again, it’s much easier to recall recent events; had you reviewed the data in February (the earliest you could have started reviewing your data for the year), you could have caught the issue and corrected it without doing so much detective work.

It’s a Responsible Practice

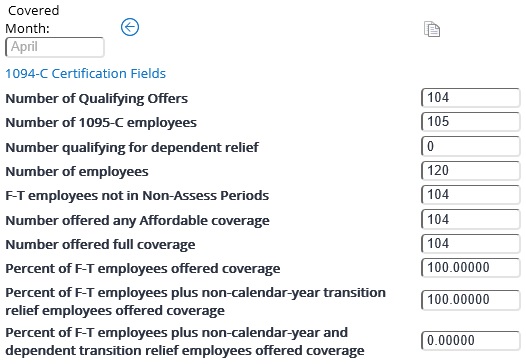

ACA reporting carries all kinds of penalties, ranging from failing to report, to not offering coverage to enough of your full-time staff, and not offering affordable coverage as required under the law. It would be irresponsible to assume you’re always in compliance. You can use your 1094-C statistics, which Vista’s ACA routines calculate on a monthly basis, to figure out where you stand. (Are you offering to 97.9 percent of your full-time staff, or the required 98 percent? You wouldn’t know for sure unless you reviewed your 1094-C data.)

You Get Cool Stats

The ACA data that Vista generates isn’t just for the IRS. You can leverage the 1094-C data to find out interesting statistics on your employee base. Vista’s ACA routines keep track of your full-time and total employee count for each month in addition to offer stats, so you might not need that special headcount report after all …

This data is available to you throughout the year as the months roll by – yet another reason to regularly interact with your ACA reporting.

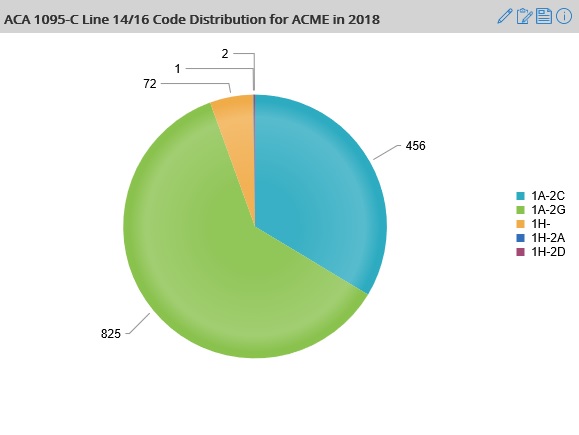

For Vista Analytics customers, we have many ACA-specific Analytics, like this one that lets you visualize your Form 1095-C Line 14 and Line 16 statistics by company …

We have others that display 1094-C data and ACA employment-related information, as well.

Get Started Now!

There’s an abundance of ACA training material on our Support Center. After logging in, click the Affordable Care Act link on the left. That will take you through the basics of ACA reporting. You can also put in a Service Center ticket if you’d like assistance from PDS Professional Services. We can guide you start to finish to successful ACA reporting; no prerequisite ACA knowledge on your side is required. (Also, PDS is an IRS-authorized ACA transmitter; we can file your ACA 1094-C/1095-C forms to the IRS at year-end, which can save you a lot of time. We do 1095-C printing, too – read our Services Brochure to learn more)

Charles P. Jefferies

Technical Consultant & ACA Specialist | PDS

cpjefferies@pdssoftware.com