Vista 7 Payroll – Data-Centric Processing

As all payroll professionals know, rules and regulations are constantly in flux. Whether at a federal or local level, your system needs to be flexible enough to quickly pivot to meet new government-mandated requirements.

Traditionally, the Payroll engine in Vista has used a consolidated tax table to facilitate tax-related updates without requiring a brand-new version of the payroll program itself. This data-centric model of storing tax rates allows for dynamic tax processing logic, which has distinct advantages over hard coding rates and rules. However, not every module in the Legacy Payroll Engine was designed this way.

With this in mind, we engineered Vista 7 Payroll to use a data-centric model wherever possible. The new payroll engine stores all compliance rules within the database, allowing for updates without delivering a new version of the program every time.

Let’s explore some of the modules in Vista 7 Payroll that utilize this new model over the traditional hard-coded approach.

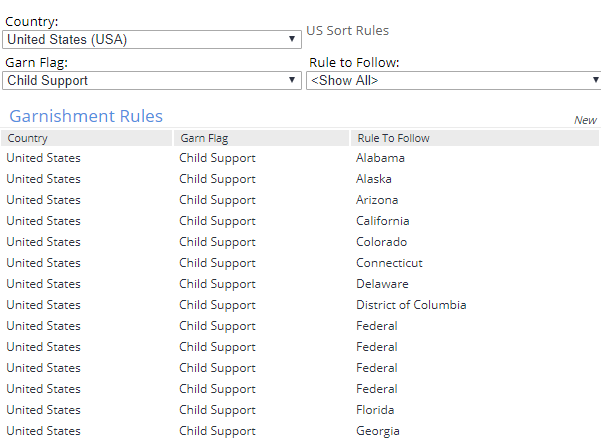

Garnishment Rule Table

The regulations surrounding garnishment processing vary from state to state and province to province. Family support, tax levies, bankruptcy, and student loan garnishments all observe different limits and processing rules, which have traditionally been embedded in the code behind the Vista payroll engine. In Vista 7 Payroll, this information is defined in the new Garnishment Rule table, which we deliver with over 450 distinct records. This includes records for child support in Pennsylvania, state tax levies in California, provincial court orders in Ontario, and every other combination you can imagine. The Vista 7 Payroll Engine references these records when determining how to accumulate disposable wages, what exemption amounts to use, and which limits should be observed.

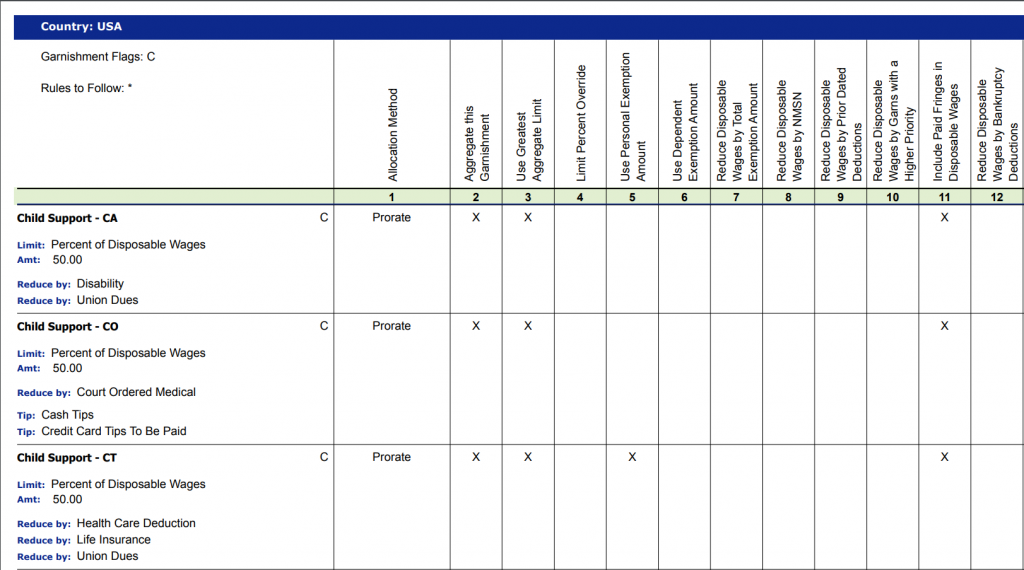

The new Garnishment Rules Setup Report provides a detailed breakdown of the differences between each state and type of garnishment:

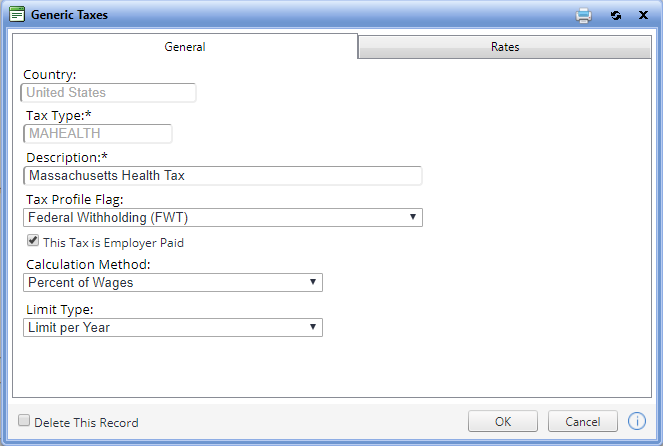

Generic Taxes

The Generic Tax Routine is another new module in Vista 7 Payroll that uses a data-centric processing model. Each record in the Generic Tax Table defines a unique code and a set of processing rules. Users can configure how taxable wages are accumulated, how tax amounts are calculated, and what limits will apply. There is a sub-table to store generic tax rates that can be effective-dated for easy maintenance. By adapting a data-centric model, the generic tax routine is equipped to easily handle new local and health taxes that haven’t yet been incorporated into the base system.

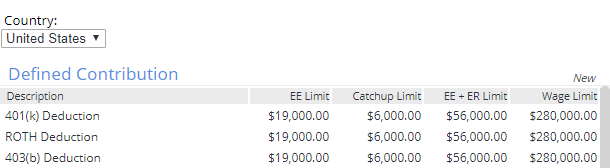

Defined Contribution

We also redefined our Tax-Deferred Type code table as a fully configurable setup table with a new name—Defined Contribution. This table stores the rules for various types of retirement deductions, like 401(k) in the U.S. or RRSP in Canada. Defined contribution processing in Vista 7 Payroll uses a data-centric model to determine the appropriate size of a contribution and the impact that contribution should have on an employee’s taxable wages. Effective-dated limits are also stored right alongside the Defined Contribution record for easy access and reporting.

These are only a few examples of how Vista 7 Payroll streamlines compliance updates and improves processing functionality. Follow along with the rest of our Vista 7 Payroll blog series to learn more about the architectural and design changes that make the new payroll engine so powerful.

If you’re live on Vista 7 and interested in volunteering for the Vista 7 Payroll Beta, please log in to the PDS Service Center. Create a new Customer Support ticket and select “Vista 7 Payroll Beta Request” from the Application field. PDS will provide the beta documentation and additional components needed to participate in an early review of Vista 7 payroll.

Read the previous article in our payroll blog series: Online Payroll Register

Start at the beginning of our payroll series: 30,000 Foot View

Ben Alaniz

Software Specialist III | PDS

balaniz@pdssoftware.com